Remuneration payable by the seller: Exclusive brokerage contract – Sale

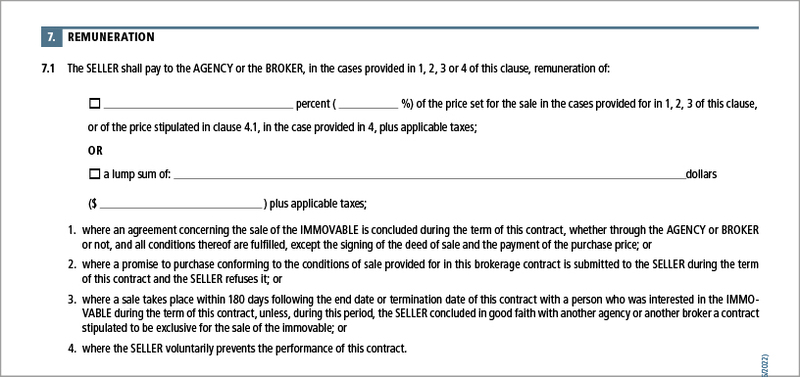

Before examining the various cases in which remuneration is payable by the seller to the agency or the broker acting on his own account, let us briefly consider what form the broker’s remuneration may have under the Exclusive brokerage contract – Sale.

The first possibility is for the remuneration to take the form of a percentage of the sale price:

For example, if the sale price stipulated in clause 4.1 is $300,000 and the seller ends up accepting $295,000 pursuant to a promise to purchase presented to him, the percentage indicated in section 7.1 would then be applied to the sale price accepted by the seller, i.e. $295,000.

The other form that the remuneration of the agency or the broker acting on his own account can take is a lump-sum amount, i.e. a set amount.

It is important to remember that the form Annex RC – Remuneration and Costs allows the agency or the broker to provide for other methods of remuneration that those stipulated on the mandatory brokerage contract to sell form and, if applicable, to have specific costs paid by the seller.

Remuneration will be paid if one of the four events stipulated in clause 7.1 outlined below occurs.

“1. Where an agreement concerning the sale of the IMMOVABLE is concluded during the term of this contract, whether through the AGENCY or BROKER or not, and all conditions thereof are fulfilled, except the signing of the deed of sale and the payment of the purchase price.”

What meaning is to be given to the words “and all conditions thereof are fulfilled”? These are essentially, but not exclusively, the provisions of section 4 of the brokerage contract, which states the sale price and conditions, including which items are included or excluded from the sale, and also of clause 5, which concerns the date or deadline for occupancy and for the signing of the deed of sale. Other conditions may also be indicated elsewhere in the brokerage contract, for example in clause 11.1 - “Other declarations and conditions”, or in the recommended form Annex G – General. In the event that a promise to purchase is presented that satisfies the conditions of sale set out in the contract and this promise to purchase is accepted, in principle the agency or broker will be entitled to remuneration.

Most often the agreement to sell the immovable takes the form of a promise to purchase presented through the broker responsible for carrying out the brokerage contract to sell, or through the broker of a potential buyer. However, it is possible for the promise to purchase to have been prepared by another person, e.g. a notary. It is also possible that, in the case of an existing or planned residential immovable being sold by a builder or a promoter, it is a preliminary contract as referred to in articles 1785 and following of the Civil Code of Québec.

Regardless of the form the agreement takes, it must be accepted for the broker to be entitled to remuneration. However, even if an agreement is entered into “whether through the agency or broker or not”, the broker will be entitled to remuneration. Remember that under subsection 2. of clause 8.2 of the exclusive brokerage contract, the seller has undertaken not to, directly or indirectly, during the term of the contract, “become party to an agreement for the sale or exchange of the IMMOVABLE other than through the AGENCY or the BROKER”.

Therefore, except in case of fault on the part of the buyer, the broker or agency will be entitled to remuneration if an agreement to sell the immovable is accepted during the term of the contract, whether through the agency or the broker or not, and all conditions of this agreement are fulfilled, except the signing of the deed of sale and the payment of the purchase price. The deed of sale does not need to be signed for the remuneration to be payable to the broker or the agency even if, in practice, the remuneration is actually paid after the signing of the deed of sale from the proceeds of the sale, in accordance with clause 11.4 of the mandatory form Promise to purchase.

“(2) where a promise to purchase conforming to the conditions of sale provided for in this contract is submitted to the SELLER during the term of this contract and the SELLER refuses it”

Since the seller is not obliged to sell, this clause states that if a promise to purchase conforming to the conditions of sale is submitted to the seller but is not accepted by him, the broker or the agency are still entitled to their remuneration.

“(3) where a sale takes place within 180 days following the end or termination date of this contract with a person who was interested in the IMMOVABLE during the term of this contract, unless, during this period, the SELLER concluded in good faith with another agency or another broker a contract stipulated to be exclusive for the sale of the IMMOVABLE”

The 180-day period is calculated from the termination date specified in the exclusive brokerage contract. If the contract was amended to extend its term, the period will be calculated from the new termination date. In the case of a revocable contract where the seller has exercised his right to terminate, the 180-day period will begin as of the date of termination.

On another topic, what meaning is to be given to the expression “person who was interested in the immovable during the term of this contract”? The courts have rendered a few decisions on this matter, but it is difficult to determine accurately whether, in a given situation, a person was or was not interested in an immovable during the term of the contract. However, some situations are quite clear. For example, if a person visited the immovable or presented a promise to purchase during the term of the contract, one can consider that that person was interested in the immovable. But even if a sale is concluded with such a person within 180 days following the expiry of the contract, the broker would not be entitled to remuneration if “during this period, the SELLER concluded in good faith with another agency or another broker a contract stipulated to be exclusive for the sale of the IMMOVABLE”, as provided for in subsection (3) of section 7.1.

“(4) where the SELLER voluntarily prevents the performance of this contract”

This clause applies in the case where a seller acts in a way that results, for example, in preventing the agency or the broker from properly performing their obligations under the brokerage contract, or that results in the deed of sale not being signed despite the fact that a promise to purchase was accepted during the term of the contract. This means that, even in the absence of a proper sale form, and occasionally even in the absence of a promise to purchase, the agency may still be entitled to remuneration.

The courts have frequently given effect to this clause. For example, a seller who acts to prevent the broker from showing the property to potential buyers, or who takes steps not to be available for the presentation of a promise to purchase would, in all probability, be preventing the free performance of the contract by the broker, subject of course to the particulars of each case.

Finally, when taking up any brokerage contract, the broker must be sure to explain to his client that the taxes are calculated on the remuneration payable under section 7.1, meaning that they are in addition to the remuneration.

When taking up any brokerage contract, the broker must be sure to explain this clause to his client, emphasizing that the taxes are calculated on the remuneration payable under section 7.1, meaning that they are in addition to the remuneration.