The Real Estate Indemnity Fund (FICI)

The FICI offers free protection to consumers who do business with a broker or agency and are victims of fraud, fraudulent tactics, or misappropriation of funds during a transaction.

The Fund

It was created under the Real Estate Brokerage Act and is funded by the annual contributions paid by all real estate agencies and brokers in Québec.

Decisions regarding claim admissibility and the amount of compensation to be paid, in accordance with the rules set out in the Organization’s regulations, are entrusted to an indemnity committee under the Real Estate Brokerage Act. The indemnity committee is independent, that is, it is not bound by any judicial decision and its purpose is not to cover the civil or professional liability incurred by licence holders for civil or ethical faults. This committee is made up of three to nine members, appointed by the OACIQ Board of Directors.

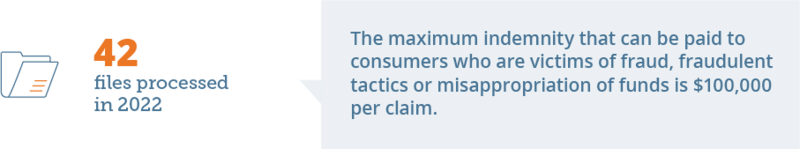

Although the OACIQ manages the FICI, the Fund’s assets are completely separate from those of the Organization and used exclusively to pursue the Fund’s mission. The OACIQ is responsible for compensating victims from the sums contained in the Fund, in accordance with the decisions of the Indemnity Committee. The maximum compensation that can be paid is $35,000 per claim for an act committed on or after May 10, 2018. The maximum compensation per claim is increased to $100,000 for an act committed on or after May 10, 2018. Any claim must be filed by completing a Request for assistance within two years of becoming aware of the alleged act.

Compensation cases

Brokers and agencies must comply with various regulations aimed at protecting the public. Although the actions described hereafter seldom occur, they can result in compensation.

It should be noted that an OACIQ licence holder may not submit claims as such.

Fraud and fraudulent tactics

The Indemnity Committee can assist you if, for example, you were voluntarily misled by a broker during a real estate transaction, whether by misrepresentation or by his silence and you suffered direct damage. Fraud, like deceit, includes a voluntary and intentional element.

A few examples:

- If a broker has intentionally concealed from you an unfavorable inspection report;

- If a broker knowingly ignored the fact that the immovable was used to grow cannabis.

Misappropriation of funds

You can benefit from the protection provided by the Indemnity Fund if you are unable to recover the sums entrusted to a broker. For example, if the broker illegally used a deposit for the acquisition of a property for his own benefit.

What other recourses are available?

Some reprehensible actions may not necessarily constitute fraud, a fraudulent tactic, or a misappropriation of funds. We suggest that you contact Info OACIQ to find out about other protections which may be available to you.

To learn more about the procedures and criteria for the eligibility to file a claim, as well as the required evidence, visit the Indemnity Committee’s page.

PLEASE NOTE: We recommend ensuring that your broker or your agency does indeed hold a valid licence. Otherwise, the person who is being remunerated for a brokerage transaction is being so illegally, and you will not be able to apply to the Fund in case of a problem. To check if your broker has a valid licence, consult the Register of licence holders.

Fortunately, cases of fraud, fraudulent tactics, and misappropriation of funds by real estate brokers or agencies remain infrequent and the victims few, especially considering the thousands of brokerage transactions that are carried out each year in Québec.

See the Organization’s annual report for FICI’s statistics.