Gross Debt Service (GDS)

The analysis of the borrower has so far focused on verifying his income and willingness to pay by examining his credit history. However, an important part of a borrower’s capacity to repay is also based on the relationship between his income and the loan applied for.

Two ratios are used to determine whether the borrower has sufficient income to repay his debts. The Gross Debt Service ratio (GDS) includes all housing-related debts. The Total Debt Service ratio (TDS) includes all housing-related debts plus all other loans (credit card balances, car loans, etc.).

Gross Debt Service ratio (GDS)

The Gross Debt Service ratio is the percentage of eligible annual income required by the borrower to make all housing-related payments, including:

- principal

- interest

- property taxes (municipal and school taxes)

- heating costs

- co-ownership fees (50%), if applicable

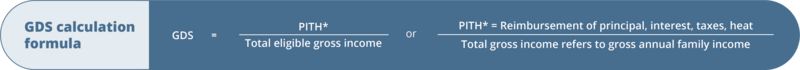

The first four costs (principal, interest, taxes, and heat) are referred to by the acronym “PITH”*.

Since GDS is a ratio, it is important that the two figures being compared correspond to the same period. For example, if PITH payments are monthly, they should be divided by the borrower’s total monthly income. If PITH payments are calculated for an entire year, they are divided by the borrower’s annual gross income. This also applies to the TDS discussed in the next section.

Generally speaking, lenders accept a maximum GDS ratio of 32% for conventional loans and 39% for insured loans. In other words, only 32% or 39% of the borrower’s gross income can be devoted to PITH payments (plus half the co-ownership fees for loans with a loan-to-value ratio of 80% or less).

This limit is based on practice and institutional policies, as well as on the insurer’s standards (e.g. CMHC for a high-ratio loan). For insured high-ratio loans, the default insurance premium is added to the mortgage amount, and the GDS includes the premium.

Example of GDS calculation.

Mortgage payments (principal and interest): $1,100 per month

Taxes: $100 per month

Heating: $75 per month

Monthly income: $4,500

How is GDS calculated?

This gives a percentage (x 100) of 28.33%. Using this measure alone, the client would qualify for a mortgage, since his GDS of 28.33% is below the maximum ratio of 32%.